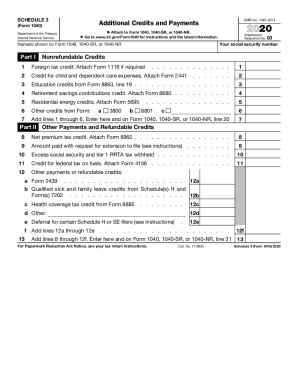

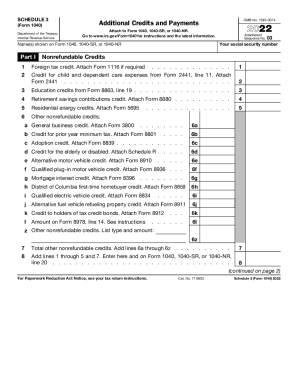

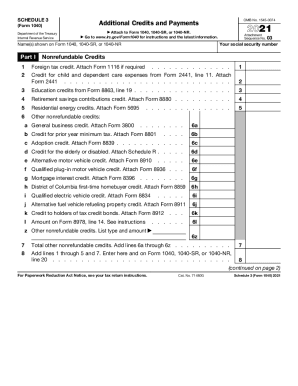

2024 Form 1040 Schedule 3 Fillable – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule D you will need to complete Form 1040 through line 43 to calculate your .

2024 Form 1040 Schedule 3 Fillable

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 schedule 3: Fill out & sign online | DocHub

1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com2024 Form 1040 ES

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 3 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.com2024 Form 1040 Schedule 3 Fillable Schedule 3: Fill out & sign online | DocHub: Gather each tax form you need to fill out for the type of business you own. Sole proprietors may only need the form 1040, Schedule SE for self employment taxes, and Schedule C-EZ for reporting the . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D Crypto Tax Myth #3 – You only owe taxes to the IRS if you receive a Form 1099-B. .

]]>